The aluminium market consists of the producers of primary aluminium and its alloys – the upstream segment, the producers of aluminium products – the downstream segment and the producers of aluminium out of processed raw material (aluminium recycling).

The world’s largest aluminium producers are, as a rule, vertically integrated holding companies comprising bauxite mines and alumina refineries. Small producers, on the other hand, procure raw materials from outside suppliers.

The Demand – Supply Gap

The global aluminium market will see a number of deficits over the next few years as solid demand growth, driven by the construction and autos sectors, outpaces production growth.

The global aluminium demand outlook will benefit from solid construction industry growth and growing roles in autos as a lightweight substitute for steel.

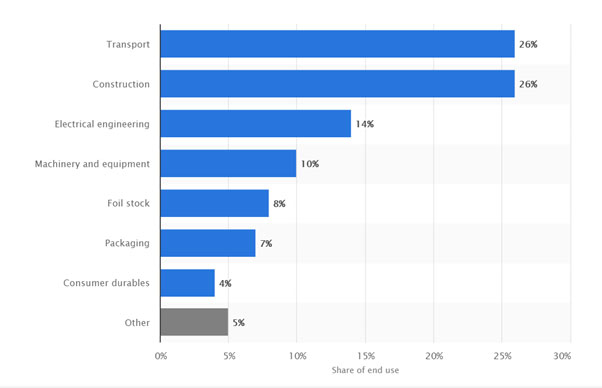

As evident in Figure 1 above, both the construction Sector and the Transport Sector combined command more than 50% share of Aluminium as End Use.

The automotive and aerospace sectors will increasingly support aluminium demand in key markets, as an environmentally preferable alternative to steel.

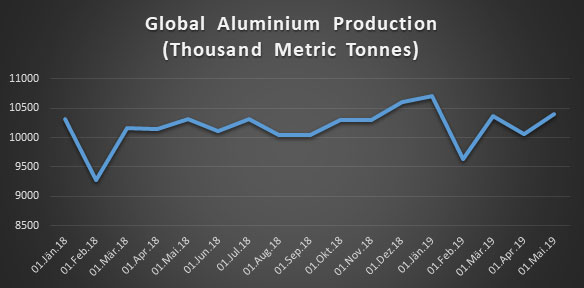

As evident in the production chart above, global production of Aluminium has shown a decline since beginning of 2019. Although there are signs of recovery and growth in production in last 2-3 months. The demand side is expected to grow at an even faster pace.

For the analysis of production data, we have utilised our own MINRIS App developed by Minpol GmbH. If you are interested in augmenting your research requirements for the Metals & Energy Sector, please check out the app on the Google Playstore.

China’s aluminium production growth may slow down over the coming years, as the government’s push for consolidation and stricter environmental regulations brings higher-cost and less efficient capacity offline.

Aluminium integration will continue in more regulated automotive markets such as the US, the EU and Japan, while developing markets will show further growth opportunities. While we expect this trend to continue over the long-term, rising aluminium prices will present near-term headwinds to the integration of the metal in the autos sector as carmakers look to keep costs down.

While there are deficits ahead, the global aluminium demand picture will improve, driven by steady demand growth in Asia and the growing application of aluminium in the auto and aerospace industries.

Contributed By Utkarsh Akhouri

About Author:

Utkarsh Akhouri is currently Head of Operations (Asia – Pacific) in Minpol GmbH and has led the product development team for MINRIS App. He has graduated from Indian Institute of Technology, Kharagpur with Bachelor’s Degree in Mining Engineering and Master’s Degree in Financial Engineering.

Recent Comments